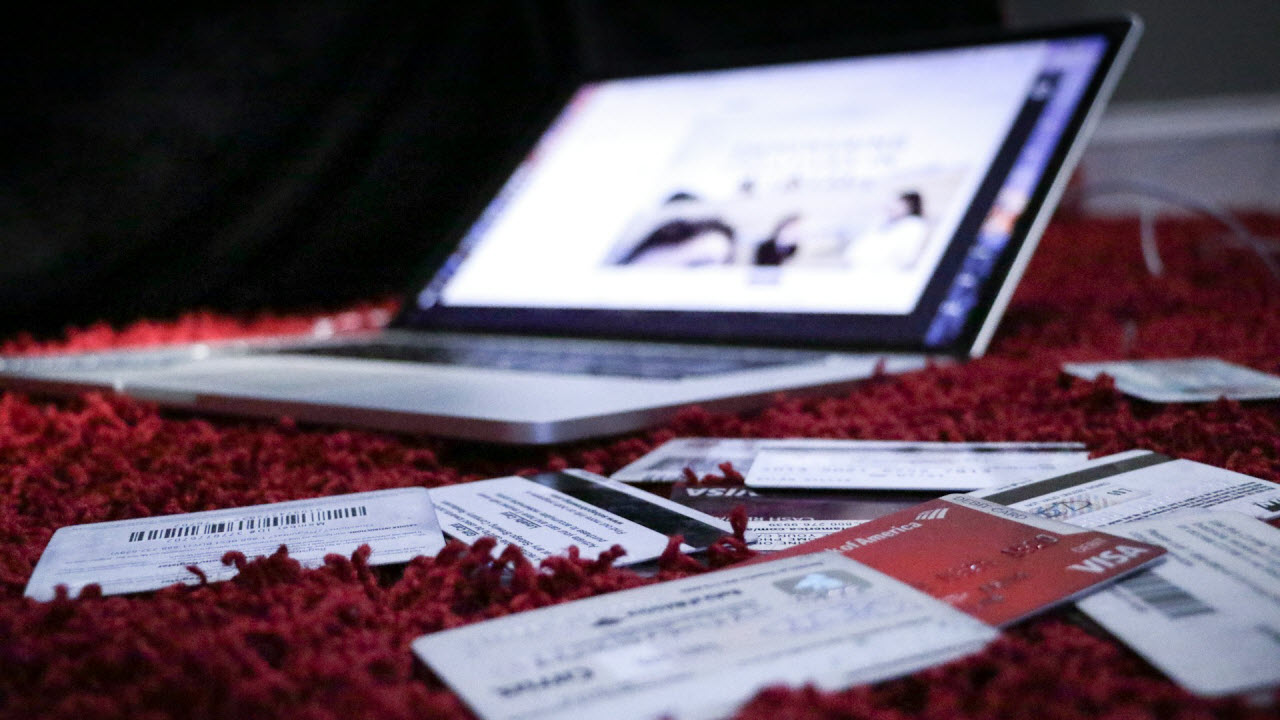

Understanding Credit Card Float—And How to Avoid It

What is it, how does it work, and how do you avoid the potential pitfalls that come with it?

Let’s break down what credit card float is, how it works, and, most importantly, how to avoid the potential pitfalls that come with it.

What Is Credit Card Float?Credit card float is the time between when you charge a purchase on your credit card and when you actually have to pay for it. Essentially, when you use a credit card, you're borrowing money to make a purchase, but the payment isn't due right away.

For example, let’s say you buy a pair of shoes on January 1st. Your statement closes on January 31st, and your payment isn't due until February 25th. That gives you up to 55 days to pay for the purchase without spending your own cash immediately. This delay in payment is known as the "float."Now, most of us are aware that if you pay your statement in full by the due date, you won’t incur interest charges. This makes credit card float seem like a good deal—allowing you to borrow money for weeks at no cost.

However, there’s a catch. Even if you consistently pay off your credit card bill each month, you may unknowingly be “riding the float,”—meaning you’re using this month’s income to pay for last month’s expenses. Over time, this can leave you one payment behind without realizing it.A simple way to determine if you're financially stable or "riding the float" is by checking if you are fully funded__.__ Here’s how:

- Add up all your current credit card balances.

- Subtract that total from your checking account balance.

- If you don’t have enough money to pay off your credit card balances right now fully, you're riding the float.

This means you’re relying on your next paycheck to cover what you already spent—leaving little room for unexpected expenses or financial flexibility.

How to Avoid Credit Card FloatTo prevent falling into the float trap, you need to make sure you have enough money before making a credit card purchase__.__ That way, when your bill arrives, you can pay it from your checking account without dipping into savings.

A few strategies to ensure financial stability include:

- Using the Envelope System: If you budget using FaithFi’s Envelope System, you can reconcile your credit card envelopes to ensure you’re not overspending.

- Maintaining a Checking Account Cushion: Always keep enough in your checking account to cover both your credit card balance and upcoming expenses before your next paycheck.

- Tracking Spending in Real-Time: Keep an eye on your available funds, not just your credit card statement balance, to ensure you’re not overextending yourself.

For example, if your total credit card balance is $2,000 and you have $1,500 in upcoming expenses, you should have at least $3,500 in your checking account to avoid financial strain.

What If You’re Already in the Float?If you discover that you’ve been riding the float, don’t panic. Here are some steps to help you get out:

- Transfer Money: Move funds from savings to cover your full credit card balance plus upcoming expenses.

- Adjust Envelope Funding: If you use the FaithFi Envelope System, reallocate funds from other categories to bring your credit card envelope balance in line.

- Fund the Credit Card Envelope Over Time: If you’ve been paying off your card monthly but realize you’ve been riding the float, start funding your credit card envelope a little more each month until it matches your full balance.

Many people unknowingly ride the float, believing they’re managing their credit cards well. However, there’s a difference between paying the statement balance and paying the full balance owed__.__

To stay financially secure, follow this simple rule: Always have enough in checking to cover your full credit card balance plus upcoming expenses. That way, you’re never relying on next month’s income to cover last month’s spending. If you’re looking for an easier way to manage your budget and ensure you’re staying financially stable, check out the FaithFi app at FaithFi.com. It’s a powerful tool to help you track your spending, budget wisely, and keep your finances in check. You can also listen to a related podcast on this topic.Related Articles

May 21, 2025

The Danger of Buy Now, Pay Later

May 18, 2025

The Hidden Danger of Buy Now, Pay Later

In a culture of instant gratification, it's easier than ever to get what we want, even if we can't afford it....

March 2, 2025

What is good debt vs. bad debt?

Is all debt bad? Or does some good debt exist? Here are the biblical principles to discern the difference....