A Road Map to Retirement Plans for Small-Business Owners

Business owners often have difficulty identifying which are best suited to their business. Let’s take a look.

What do these statistics tell you about the need to save for retirement? Everything. They underscore the importance of taking responsibility to prepare for your own retirement. This is especially true for small-business owners (and the self-employed) who don’t have a company contributing to a plan on their behalf. But small-business owners should be encouraged: they have access to the same types of plans large corporations use.

Let’s review the benefits of saving in a retirement account. One of the biggest is that funds contributed to a retirement plan usually aren’t taxed as current income. Further, contributions made by a business owner (but not employee deferrals) are tax-deductible as a business expense. And, unlike salaries, they’re not subject to payroll taxes.

Additionally, funds inside a retirement account grow tax-deferred. This means no income tax is due on contributions or the investment profits they generate until the money is withdrawn during retirement — unless one is using a Roth account. (With a Roth 401(k), contributions are taxed before going into the plan, but withdrawals of principal and earnings are tax-free in retirement.)

Offering a good retirement plan also helps attract and retain employees!

Many types of retirement plans exist, so business owners often have difficulty identifying which are best suited to their business. Let’s take a look at the plans available for use by for-profit organizations.

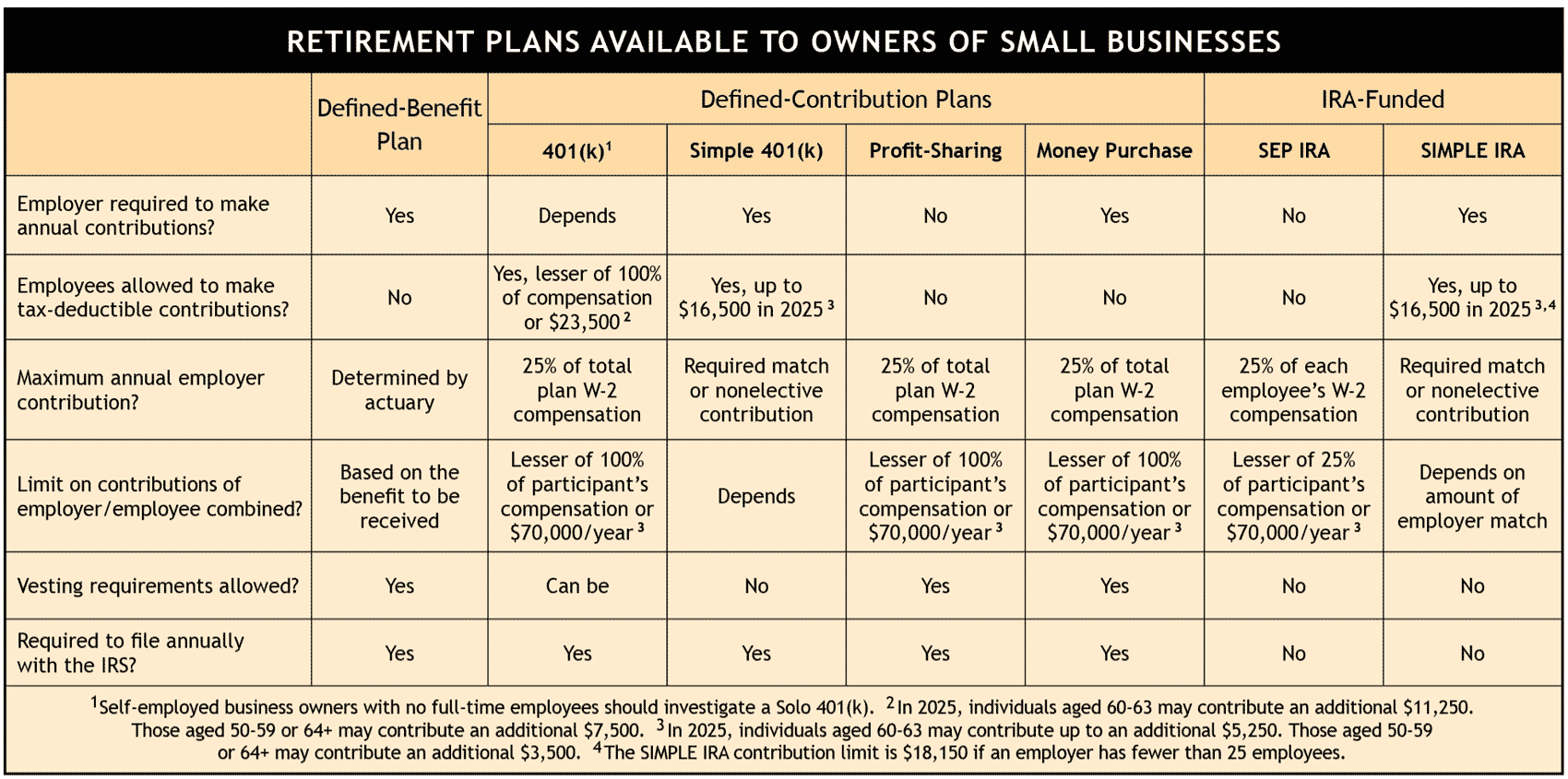

1. Qualified Plans.There are two main categories of qualified plans:

Defined benefit specifies a monthly amount a retiree will receive, i.e., a pension. For example, the plan might guarantee a retiring worker 70% of his or her pre-retirement income for life. Defined contribution specifies the contribution to be made by the employer/owner. It does not, however, guarantee a specific level of benefit at retirement. For example, the plan might specify a contribution amount equal to 3% of annual salary. The most popular types of defined contribution plans are the 401(k), SIMPLE 401(k), Profit-Sharing, and Employee Stock Ownership Plans (ESOP, not shown in table). Qualified plans must comply with extensive government rules regarding employee participation and coverage, and IRS reporting requirements can make such plans costly to set-up and maintain. 2. IRA-Funded Plans. These plans use individual retirement accounts to hold the assets in an employee’s name. But unlike traditional and Roth IRAs, an employer funds at least part of the account. The two main types of employer-sponsored IRAs are Simplified Employee Pensions (SEP-IRAs) and Savings Incentive Match Plans for Employees (SIMPLE-IRAs). Employer-sponsored IRAs typically require less time and attention to establish and maintain than qualified plans. However, these plans have a key disadvantage from the employer’s perspective: amounts are fully vested as soon as they are contributed. As the vesting row of the table below shows, IRA-funded plans don’t allow an employer to require a certain length of service before owning the funds in his/her account. If an employee quits the day after a contribution is made, the funds will still belong to him. Qualified or IRA-funded?

Qualified or IRA-funded?

There are tradeoffs when deciding which type of plan is best for your business. Contributing higher levels of money may mean annual reporting to the IRS is required (see table). Conversely, being free from the reporting requirements (IRA-funded plans) may mean contributions to employee accounts can’t follow a vesting schedule. The goal is to find a balance between flexibility and utility.Answering the following questions should narrow your choices:

- Are you willing to make mandatory contributions annually? If yes, then consider all plans. The determining factors will be which group of employees you are targeting, whether you would like employees to be able to contribute, and whether you prefer gradual or immediate vesting of contributions. (If you’d rather not have to fund the plan every year, consider only SEP-IRA, Profit Sharing, and 401(k) plans.)

- How much are you — as the employer — prepared to contribute annually? If you’re willing to commit greater than 3% of payroll, but less than $70,000 for each key employee, consider Profit-Sharing, 401(k), SEP, or SIMPLE-IRA plans. If you want to contribute $70,000 or more for key employees, consider Money Purchase, Defined Benefit, or possibly Profit-Sharing plans with some additional features.

Related Articles

May 25, 2025

How To Choose The Right Financial Advisor

For Christians who want their finances to reflect their faith, it’s about more than just numbers and returns....

April 13, 2025

Time for Foreign Stocks to Shine?

Have stocks shifted in a different Direction? Recent pickup in foreign returns has certainly grabbed our attention....

March 18, 2025