Making the Most of Your College-Savings Program

College is costly. Fortunately, there are solid tax-advantaged options for college savings.

Clearly, avoiding school debt as much as possible is a wise thing for a student to do — and parents can help tremendously.

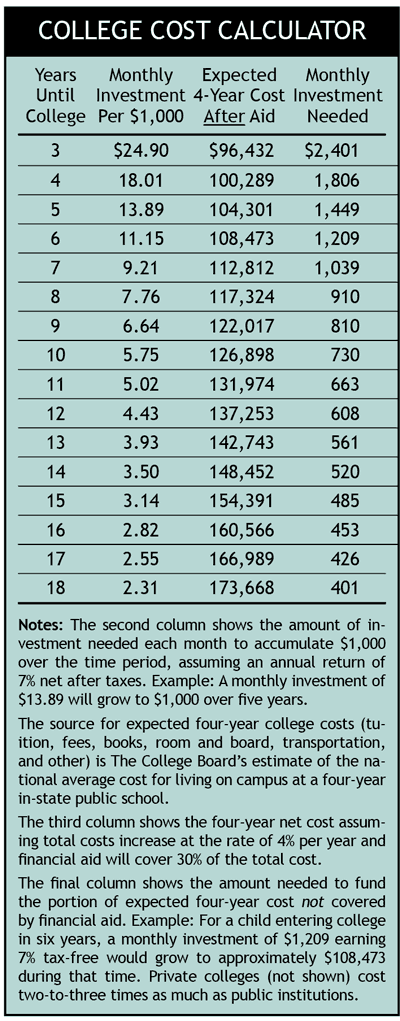

College isn’t necessarily the right next step for every high school graduate, but if you have college-bound children in your household, the first key to helping them minimize or avoid school debt is to start saving early. The longer your time horizon, the more powerfully the wonder of compounding can work for you.The College Cost Calculator below dramatically illustrates the importance of getting an early start. For example, if you have 14 years before your youngster goes off to college, you need to set aside “only” $520 per month to build a college fund of $148,452. That is expected to represent about 70% of the total (gross) cost for four years of college at an in-state public institution. A target of 70% is reasonable because most students will receive some type of student aid that will cover the balance.

If you get off to a late start, your opportunity for compounding is greatly diminished. If, for example, you have only six years remaining until college arrives for your youngster, you’ll need to invest $1,209 every month to accumulate the roughly $108,473 you’ll need for that 70% target. The four-year projected cost is less because eight fewer years of future inflation are factored in. (Schwab’s free online College Savings Calculator allows you to modify variables and create customized projections.)

If you get off to a late start, your opportunity for compounding is greatly diminished. If, for example, you have only six years remaining until college arrives for your youngster, you’ll need to invest $1,209 every month to accumulate the roughly $108,473 you’ll need for that 70% target. The four-year projected cost is less because eight fewer years of future inflation are factored in. (Schwab’s free online College Savings Calculator allows you to modify variables and create customized projections.)

Another reason to start sooner than later: the earlier you begin, the more risk you can afford to take. This means you can begin with an aggressive portfolio, making it more conservative as you get closer to freshman year. (The state-sponsored 529 plans we’ll discuss later can automate this process.)

The second key to minimizing student-loan debt is to let your kids know that paying for college is their responsibility as well as yours. Spending for college is no different than any other purchasing decision. Just as most of us can’t afford the most expensive house on the block, most of us can’t afford to foot the entire bill for an expensive education. Even if you can afford it, it may not be wise for parents to pay for everything. Expecting your children to contribute to the cost of their own education is likely to help them value that education more. So let your children know that you’ll bear the cost up to a certain amount, but beyond that it’s up to their savings, summer jobs, scholarships, financial aid, and if necessary, student loans to make up the difference.Also, it’s best to get your children involved early. Start a college fund for each child (perhaps with previous savings or cash gifts received from grandparents) and as the years go by, have your children contribute to their college nest egg as they receive money for birthdays or generate earnings from yard work, baby-sitting, or other jobs. Not only will this help your children avoid college debt, they’ll be learning that disciplined saving is the best approach to meeting future needs.

Three formerly popular options

Before the late 1990s, the most popular vehicles for college savings were EE savings bonds and Unified Gifts to Minors Act (UGMA) custodial accounts. The bonds offered tax advantages but were an inferior investment product. (In recent years, with inflation running especially hot, I-bonds were a good option as well, but no longer). The UGMA accounts offered better investing options but potential tax drawbacks.

Another college-savings option that once was widely used is the state-sponsored prepaid tuition plan. These plans still exist, but very few states continue to offer them, and even fewer guarantee that prepayments will be fully honored for future tuition.

If you’re interested in a prepaid plan and your state doesn’t have one (or if it’s closed to new savers), there is an alternative. The Tuition Plan Consortium is a group of private universities that sponsors the Private College 529 Plan. (Technically, prepaid plans fall under Section 529 of the tax code, though plans commonly referred to as “529 plans” are quite different, as we’ll see in a moment.) The plan sells “certificates” that can be redeemed for a percentage of future tuition and fees (but not room and board) at nearly 300 member schools.Today’s college savers have better options than EE bonds, UGMA accounts, and prepaid plans. The current best options are:

- Coverdell ESAs;

- Section 529 college-savings plans;

- Roth IRAs.

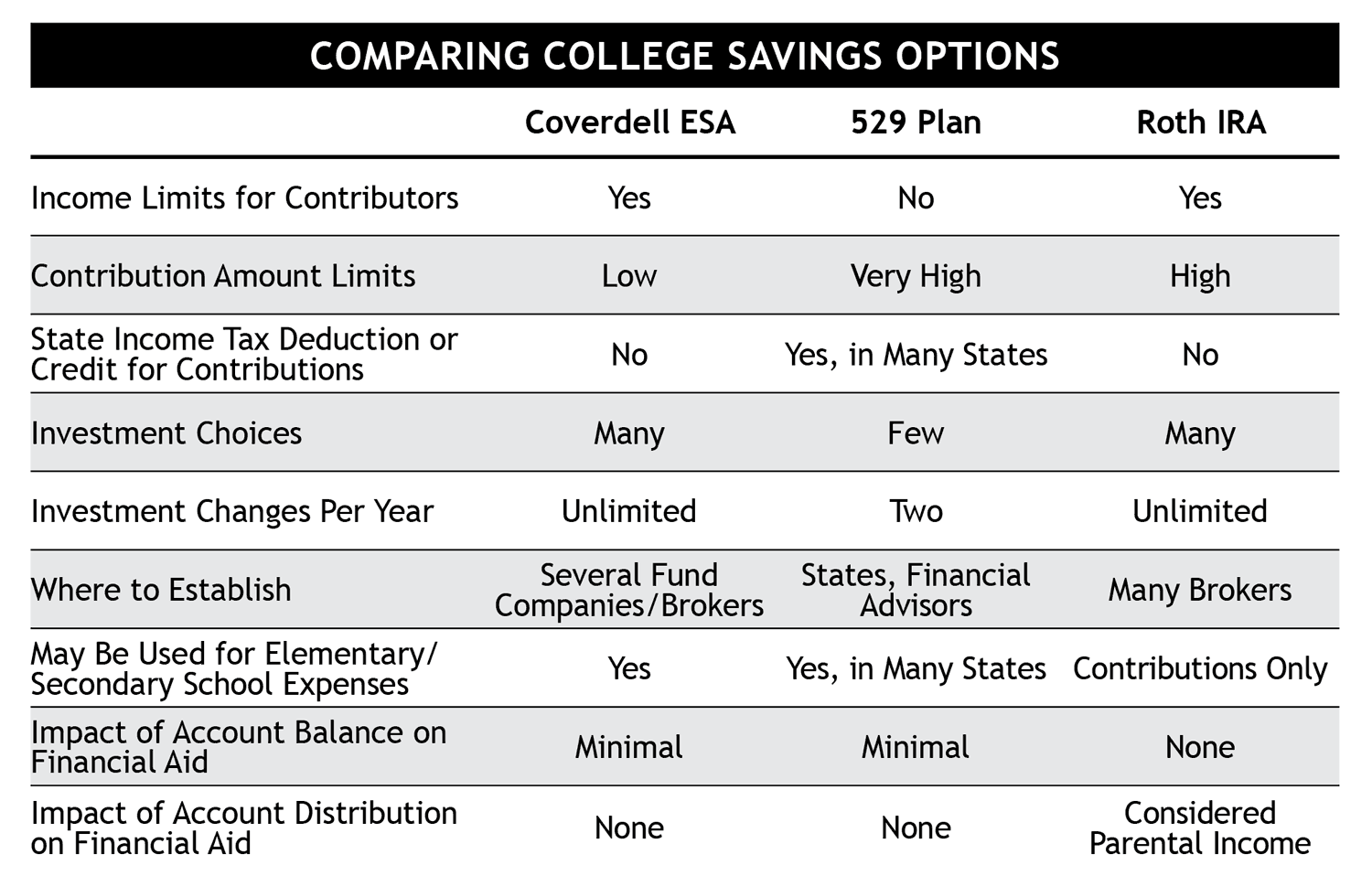

Each provides strong tax advantages and varying degrees of flexibility. And, each has downsides. Let’s look first at the options that are specifically targeted for college savings: Coverdell accounts and 529 plans.

Coverdell Education Savings Accounts

Created in 1997, Coverdell Education Savings Accounts (ESAs) are a compelling savings vehicle for parents whose income falls within the law’s limits. Parents with modified adjusted gross income (MAGI) below $190,000 (filing jointly) may contribute up to $2,000 per child, per year (for tax year 2024). The contribution ceiling is gradually lowered for taxpayers with MAGI between $190,000 and $220,000, at which point contributing to a Coverdell is not allowed. Single parents need to make less than $95,000 to contribute $2,000, with contributions completely phased out by the time MAGI hits $110,000. Coverdell contributions aren’t deductible, but all earnings grow tax-deferred and will be distributed tax-free if used to pay for a student’s qualified education expenses.

Anyone (grandparents, other relatives, friends) can contribute to a child’s Coverdell account as long as they meet the income eligibility rules, but the total contribution from all sources can’t be more than $2,000 per student, per year. That may not seem like much when college costs run into the tens of thousands per year, but a steady stream of $2,000 contributions can add up if you start early. Assuming an annual earnings rate of 7%, $2,000 per year would accumulate to more than $70,000 over 18 years.

Two big advantages Coverdells have over 529 plans are the flexibility to choose the specific investments you want and to make investment changes as often as you’d like to. Both provisions are important for those who want to direct their own investment program, as many SMI members prefer to do. (Roth IRAs have these benefits as well, whereas 529 plan account holders are limited in their investment choices and how often they can make changes.)

Several mutual fund companies or brokerages can set up a Coverdell ESA for you, allowing access to their full range of investment products. SMI Private Client, the separate but affiliated business of SMI Advisory Services, which manages individual portfolios, also offers Coverdell accounts, enabling you to have such accounts managed with SMI strategies.Another advantage is that Coverdells can be used for elementary and secondary school expenses, making Coverdell accounts particularly attractive for parents who want to send their children to a private K-12 school or get some tax-advantaged help covering certain public school expenses. (In many states, 529 plan account money may now be used this way as well.) The list of qualified expenses is lengthy, and includes obvious items such as tuition and books, as well some non-obvious items, including school uniforms, transportation, computers, and internet access for the family during the years the beneficiary is in school.

Assets in a Coverdell account are considered to belong to the parent(s) for the purposes of determining college financial aid as long as the student is still a dependent. This benefits a student who is seeking financial aid because need-based financial aid formulas weigh a student’s assets much more heavily than parental assets.

Unused money in a Coverdell may be transferred to someone else in the original beneficiary’s family who is under age 30, used to pay off up to $10,000 of student loan debt, or rolled over to a 529 plan (where it could then potentially then be moved into a Roth IRA for the 529 plan beneficiary — more details on this below). The money may also be withdrawn for non-education expenses, although income taxes and a 10 percent penalty will be due.

Section 529 plans

Over the past three decades, 529 college-savings plans have become the savings vehicle of choice for many families.

Named after a section of the U.S. income-tax code, 529 plans are sponsored by states. Most states that offer a 529 plan make it available to any U.S. resident, not just residents of the particular state sponsoring the plan. This means you can choose from a broad assortment of plans no matter which state you live in,** seeking a plan with the best investment options at the lowest cost. Moreover, students aren’t required to attend college in the state where their 529-plan money is invested; they can use the assets at any accredited post-secondary institution in the U.S., including community colleges and trade schools.

In recent years, the rules have been changed to allow up to $10,000 per child, per year of 529 plan money to be used at K-12 schools as well, whether public or private. Like Coverdell accounts, the list of qualified expenses is lengthy, including everything from tuition to computers. However, the rules are state-specific. As of this writing, more than 30 states allow 529 plan money to be used this way.

Like Coverdell accounts, money in a 529-plan account grows tax-deferred and may be withdrawn tax-free as long as it is used for qualified education expenses. Unlike Coverdell accounts, many states offer a state income tax deduction or credit for 529 plan contributions, up to certain limits.Section 529 plan accounts also differ from Coverdell accounts (and Roth IRAs) in that there is no income limit for contributors. This makes 529s a natural choice for high-income college savers. While Coverdell ESAs have an annual $2,000 ceiling on contributions, with a 529 plan the only limit the IRS has in place is that total contributions cannot exceed what’s needed to cover qualified education expenses. States set more specific caps, but they range as high as a lifetime limit of $575,000!

If you’re concerned about running afoul of gift tax rules, an individual can contribute up to $18,000 per year, per beneficiary ($36,000 for a married couple filing jointly) to a 529 plan account. There’s also a way to boost this already high limit: a contribution of up to $90,000 can be made upfront ($180,000 for a married couple), which will be treated as five consecutive annual contributions for gift-tax purposes. The bottom line for most people? State-sponsored 529 plans offer the ability to save as much as they want to.

From a financial aid perspective, using a 529 plan is a very favorable way to save for college. When it is owned by a parent or a dependent student, the account is considered a parental asset, meaning it will reduce a student’s aid package by up to a maximum of just 5.64% of the account’s value. When money is withdrawn from a 529 plan to pay for qualified educational expenses, that, too, is treated favorably. Unlike with a Roth IRA, this money is treated as a qualified distribution, not income.

Until just recently, withdrawals from a grandparent-owned 529 plan account did not receive the same favorable financial aid treatment as a parent-owned account. On the Free Application for Federal Student Aid (FAFSA), withdrawals from such accounts used to be treated as the beneficiary student’s untaxed income, which reduced aid eligibility by up to 50 percent of the distribution. As of the 2024-2025 FAFSA, that is no longer the case. Grandparents are free to help fund a grandchild’s education with a 529 plan account without worry that it may hurt the child’s chances for financial aid.

Savers using 529 plans typically are limited to a range of investment options selected by the state — a significant downside for those who want to manage their own portfolios. Most offer age-based portfolios, which operate much like target-date funds. They start out with a fairly aggressive allocation and then become more conservative as your child approaches the start-of-college target date of age 18.

Age-based portfolios offer a simple “set it and forget it” way to save. But be forewarned — there’s a huge variation in how aggressive various plans are in their allocations. For example, even in the aggressive track, money for an 11-year-old in New York’s age-based plan is invested only 50% in stocks. Many would argue that isn’t aggressive enough.

In recent years, many 529 plans have expanded their investment offerings, which now allows for a degree of fine-tuning. In addition to age-based portfolios, “static” portfolio options are now common. These allow the investor to select a specific mutual fund — or a mix of funds — that will remain constant until the investor initiates a change. Many states now offer multiple static choices. Iowa’s 529 plan, for example, has 10 static portfolios that range from an aggressive 100%-stock approach to an almost no-risk money-market account. It also has nine age-based options, each of which offers four levels of aggressiveness.

So, even though you forfeit the right to pick from a wide array of funds as you can with a Coverdell ESA or a Roth IRA, a good 529 plan will nonetheless allow you to exercise some degree of control over how your money is invested. For instance, among the 14 portfolio options in New York’s direct-sold 529 plan are eight Vanguard stock-index funds and five bond-index funds. Account holders can own up to five funds in one account and can specify the percentage to be allocated to each fund. You can change investment options twice every 12 months and redirect new contributions at any time. (You can also roll an account from a plan in one state to a plan with better investment choices in another state. This can be done only twice in any 12-month period, but it’s a relatively simple process.)

If there is money left over in a 529 plan money, you may switch the beneficiary to another child (or even to yourself if you plan to go back to school) or use up to $10,000 to pay off student loan debt. If you pull money out and use it for non-qualified (non-education) purposes, you will owe a penalty and income taxes.

One helpful new option is to roll unused 529 plan money into a Roth IRA in the name of the 529 plan account’s beneficiary — no income taxes due, no penalty. In essence, you could help your child pay for college with the 529 plan money, and then, if there is money left over, you could give them a head start on saving for their retirement. Per-year Roth IRA contribution limits still apply, but over time, you can move up to a total of $35,000 from a 529 plan account to a Roth IRA.

Many states offer both broker-sold and direct-sold 529 plans. It is generally best to go with a direct-sold plan because many broker-sold plans charge fees that you won’t have to pay with a direct-sold plan.

Which 529 plan is best for you?

With more than 80 state-sponsored college savings plans from which to choose (some states have more than one), you need to know which factors are the most important when comparing plans. Because Congress has permitted the states to be in charge of 529 plans, each state does its own thing — with different rules for tax incentives, contribution limits, investment options, and more. All that innovation is a good thing, but the wide variety of options can create confusion for parents. Here, then, are a few suggestions as to which factors are most important when selecting a 529 plan.

Roth IRA

Although Roth IRAs are designed for retirement, they can be useful under certain scenarios for college planning. You can withdraw your Roth contributions for college expenses without tax or penalty. If you’re 59 ½ or older, you’ll get tax- and penalty-free treatment on the withdrawal of earnings as well. However, if you’re younger than 59 ½, Roth earnings used for college may be withdrawn penalty-free but not tax-free. Ideally, if you use Roth IRA assets to help pay for college, you’ll leave any earnings in the account while withdrawing only from the principal.As with a 529 plan, a Roth IRA allows for some hefty yearly contributions. Under current (2024) law, a married couple can put $14,000 per year in Roths ($16,000 if they’re 50 or older). Single parents can put $7,000 per year in a Roth ($8,000 if they’re 50 or older). Those who have the wherewithal to sock away more can always put additional money in a Coverdell or a 529 plan account.

There is a caveat to those generous contribution ceilings, though. Unlike a 529 plan, there are income rules that limit who can contribute to a Roth. Married couples filing jointly need their modified adjusted gross income to be under $230,000 in order to qualify for a full contribution. At that point, allowable contribution amounts decrease until they are completely fazed out at a MAGI of $240,000. For single parents, MAGI needs to be under $146,000 in order to qualify for a full contribution. The opportunity disappears once MAGI hits $161,000.One advantage to using a Roth for college savings is that if your child gets a hefty scholarship or decides not to go to college, there’s no need to sort through the various options and restrictions for unused money in a Coverdell account or 529 plan. The money will already be in the most tax-advantaged spot for your retirement savings!

Here’s another scenario: Let’s suppose you’re blessed with making big bucks by the time your kids go to college and can pay most college bills out of current income. You could then take only minimal withdrawals from your Roth, keeping the majority of the account intact and growing. This would be helpful because at that point you may no longer be eligible to make Roth contributions due to your high income.

However, before you decide to go the Roth route for college, you need to know there’s a potential downside to using a Roth IRA to save for higher education. It has to do with how IRAs are treated in financial aid formulas. Most such formulas consider family income as well as family assets. Although a parental IRA isn’t counted as an asset in the formulas, withdrawals from an IRA — even if you’re only withdrawing your contributions, not earnings — are counted as income.Coverdell ESAs and Section 529 plans, in contrast, get the opposite treatment — they count (relatively lightly) as parental assets, but withdrawals don’t count as income. As a result, if you think your child may qualify for financial aid, saving for college via a Coverdell or a 529 plan may be a better choice than doing so via a Roth. At a minimum, try to wait until the child’s junior year of school to tap your Roth IRA. At that point, the extra income won’t matter. That’s because it would impact aid for the school year two years down the road, and by then, your child presumably will already have graduated.

The main reason to consider a Roth for college savings is that the financial road is filled with bumps and unexpected turns. If it ever comes down to an either/or situation between saving for retirement or saving for college, it’s far better to have a reasonable level of retirement savings than a large college savings fund. Remember, it’s hard to borrow money for retirement; however, Uncle Sam (and private lenders) will happily lend your child money to attend college. Of course, it’s best to avoid such loans if possible, but don’t give up planning wisely for retirement in an attempt to fund college for your children.

Conclusion

The current college-savings landscape offers three solid options. A Coverdell ESA is our recommendation for the best place for most college savers to start. It offers tax-free investment growth (assuming the funds are used for qualified education expenses) and also a wide array of investment choices that allow you to follow the strategy of your choosing, including SMI’s strategies. If you’re able to save more than the $2,000 allowed per child each year in a Coverdell ESA, you can also contribute to a 529 plan and/or a Roth IRA. Having a mix of these account types will provide you with great flexibility as your future financial situation becomes clearer.

Section 529 savings plans are another great option, offering high contribution limits, tax-free investment growth, and in many states, a state income tax deduction or credit for contributions. And now there is an option to roll unused 529 plan money into a Roth IRA for your child’s future retirement needs. The main drawback to a 529 is that you will probably have to “settle” for an indexing strategy, as opposed to being able to follow a potentially more profitable strategy (including SMI’s strategies) as you could within a Coverdell ESA or Roth IRA.

For those who prefer to chart their own investment course, and especially if you think your child won’t qualify for financial aid, fully funding a Roth every year as a joint retirement/college savings account is a good approach. The main downsides are that higher-income parents may not qualify to contribute to a Roth and income taxes will be due on any account earnings used to pay for college.

As we have seen, Coverdell ESAs, 529 plans, and Roth IRAs all have pros and cons. Don’t get so caught up trying to figure out the best option that you postpone making a decision. Any combination of these three choices is better than waiting. Review the options, pray for wisdom and discernment, and get started! Contributing early and often is the best way to make the most of your college-savings program. Image used with permissionRelated Articles

January 24, 2025

Your Future Self Has No Time for These 3 Excuses

The high cost of waiting to save is real....

January 22, 2025

Your Guide to Stay on Track for a Secure Retirement

By now, you’re likely well on your way to saving for retirement....

January 22, 2025

Retirement Planning for People in Their Mid-50s and 60s

It may be hard to believe how quickly the years have passed....