The Coverdell ESA – Still a Good Way to Save for College

For some families, there’s another way to save for college on a tax-advantaged basis.

However, for some families, there’s another way to save for college on a tax-advantaged basis. While it comes with significant restrictions, it also comes with one very appealing advantage over a 529 plan account. “It” is a Coverdell education savings account, named for the late Sen. Paul Coverdell of Georgia.

Since its introduction in 1997 as an “education IRA,” the account has been renamed, revamped, and seemingly relegated to the dust bin. But reports of its death have been greatly exaggerated. While the amount of assets in such accounts is a small fraction of that in 529 plans ($7 billion vs. $425 billion, according to the Education Data Initiative), the Coverdell is still alive and kicking. Qualifying families with college-bound kids under roof would be wise to consider using it — not as a replacement for a 529 plan account, but as a supplement.

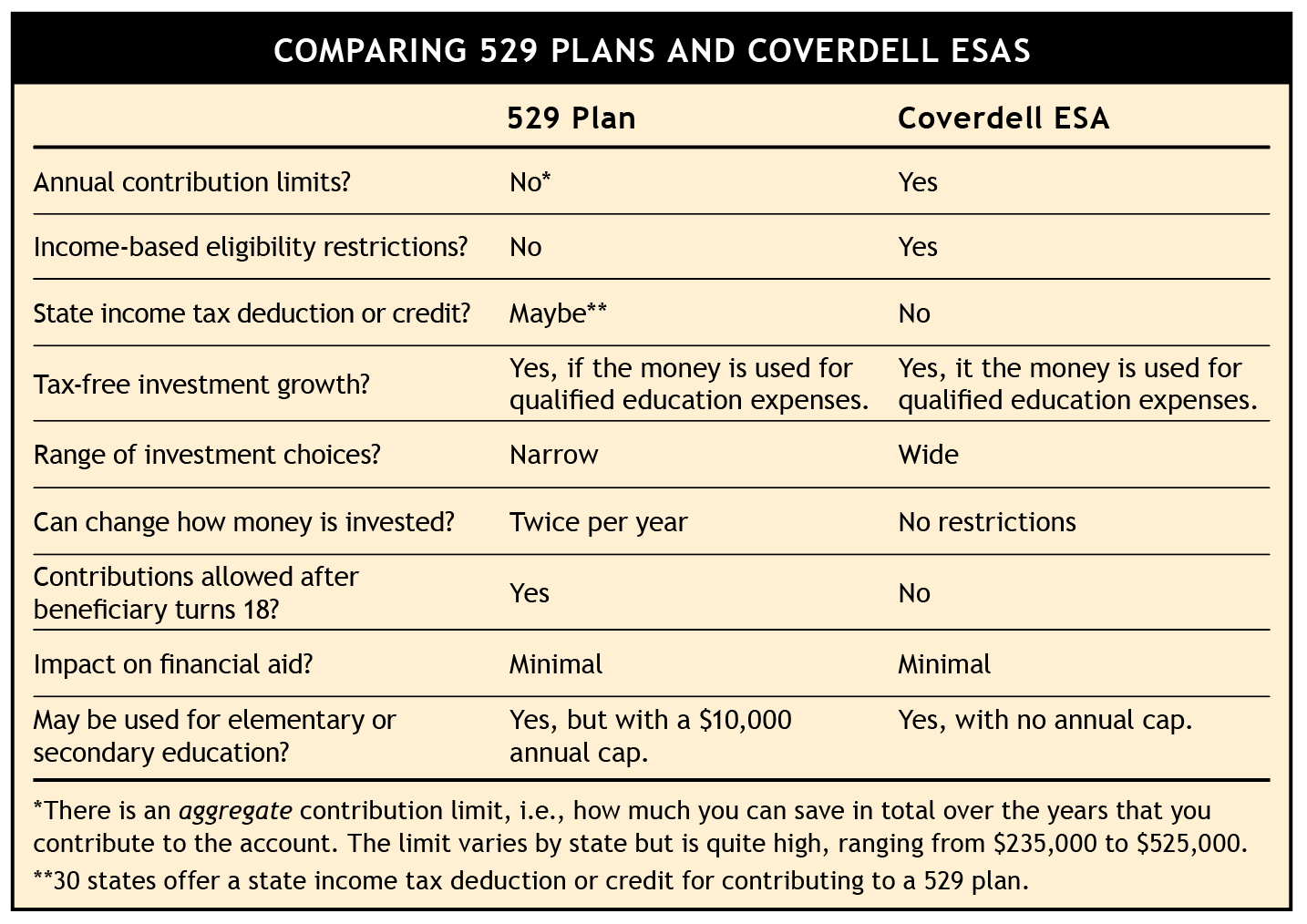

Coverdell pros & consTo be sure, the Coverdell has its downsides. First is a very restrictive contribution limit of just $2,000 per child per year. Second, there are income limits that restrict who can utilize such accounts. In order to make a full $2,000 contribution, married couples that file their tax returns jointly need to have modified adjusted gross income (MAGI) below $190,000. From there, as income rises, the contribution ceiling lowers. At $220,000 of income, a Coverdell is no longer an option. Single parents need to make less than $95,000, with contributions completely phased out by the time MAGI hits $110,000. The third strike against Coverdell ESAs is that while investment gains are tax-free as long as the money is used for qualified education expenses, there are no deductions or credits available for contributions.

However, for those who qualify, the Coverdell has one very significant advantage over a 529 plan account: A much broader assortment of investment choices. Whereas 529 plans are typically limited to age-based investment portfolios that work similarly to target-date retirement funds, as well as a limited menu of individual mutual funds, Coverdell account balances may be invested in most investments offered by the sponsoring broker. That makes the Coverdell perfectly suited to SMI’s strategies. Plus, whereas 529 plan accounts permit investment changes just twice per year, there are no such restrictions with a Coverdell. That, too, works in favor of those wanting to follow an SMI strategy with Coverdell money.

Details, details

Details, details

Just as with a 529 plan account, money in a Coverdell ESA, even if owned by a dependent student, is considered a parental asset. As such, only 5.64% of the balance above $10,000 is factored into the financial aid formula.

One other difference between Coverdell ESAs and 529 plan accounts is that contributions to a Coverdell must stop once a beneficiary reaches age 18 whereas contributions to a 529 plan account may continue.

One advantage Coverdell ESAs used to have over 529 plan accounts was that money in such accounts could be used not just for college expenses, but for qualified elementary and secondary education expenses as well. Today, both Coverdell and 529 plan account money may be used for all such expenses. However, 529 plan account holders are limited to using a maximum of $10,000 for K-12 expenses. There is no cap on the amount of Coverdell money that can be used for those purposes.SMI-recommended brokers that offer Coverdell accounts include Schwab, E-Trade, and TD Ameritrade.

For SMI members who are saving for college and trying to figure out the optimal way to use a Coverdell ESA and a 529 plan account, here’s SMI’s guidance. If you live in a state that provides a state tax deduction or credit for 529 plan contributions, start there, contributing up to the amount that’s eligible for that tax break. Then use a Coverdell ESA for additional contributions so that you can follow your SMI strategy of choice with that account. If you want to make further contributions, add more to your 529 plan account.

If your state does not provide a tax benefit for 529 plan contributions, start with a Coverdell. Once you hit the $2,000 annual limit per child, make any additional contributions to a 529 plan account. Pairing a Coverdell ESA with a 529 plan account is the optimal way to save for college with the best combination of tax breaks and the flexibility to use an SMI strategy to manage at least a portion of your college portfolio. image used with permissionRelated Articles

January 24, 2025

Your Future Self Has No Time for These 3 Excuses

The high cost of waiting to save is real....

January 22, 2025

Your Guide to Stay on Track for a Secure Retirement

By now, you’re likely well on your way to saving for retirement....

January 22, 2025

Retirement Planning for People in Their Mid-50s and 60s

It may be hard to believe how quickly the years have passed....