Too Much Plastic: How to Close a Credit Card Account

Many people find themselves holding numerous credit cards. If that includes you, should you close some?

In a quest to take advantage of enticing sign-up bonuses, many people find themselves holding numerous credit cards. If that includes you, should you close some?

Perhaps you want to avoid the annual fees some of your cards charge, or it’s just too much work to keep up with all the cards, or maybe it feels like a risk to have access to so much credit. Whatever your reason for closing an account, it pays to be intentional about which cards to close and how.

Could it hurt my credit score?

You may have heard that it’s best to avoid closing a card you’ve held for a long time. “Credit history” is one of the five main factors determining your credit score, so you may be concerned about shortening your history. That’s a valid concern, but probably not to the degree that you assume.

According to Experian, one of the three credit reporting agencies (TransUnion and Equifax are the other two), a long track record of managing credit cards is an important factor in building a strong credit score — especially if that experience is marked by consistency in paying your bills on time.

Credit-scoring models use several “credit age” metrics when tabulating your score, including how long you’ve had your oldest account and the average age of all your accounts. However, the two companies that issue credit scores treat closed accounts differently.FICO (originally Fair Issac Corporation), the originator of credit scores and the company whose scores most lenders use, will continue to access the history of any closed accounts for up to 10 years. So, closing an account shouldn’t impact the history portion of your FICO credit score anytime soon.

VantageScore, a company created by the three credit bureaus, apparently uses a different approach. According to Experian, the VantageScore calculation “might not include some closed accounts in its credit age calculations, depending on your credit profile and the type of account that was closed. As a result, closing the account could lower your average age of all accounts, and may hurt your VantageScore credit scores.” (“Might not include some closed accounts”? No wonder credit-score tabulation methodologies continue to seem like a mysterious “black box”!)

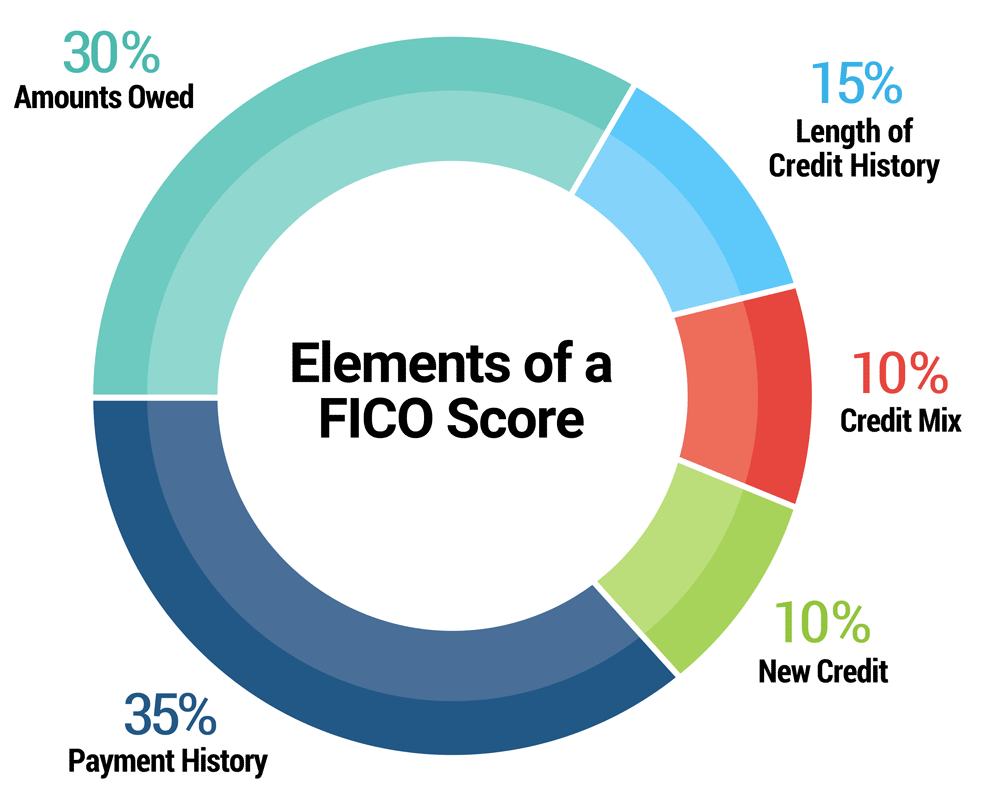

Another factor to consider here is your “credit utilization” (or “amounts owed,” as shown in the graphic below). This refers to how much available credit you are using at a given point.

The utilization calculation doesn’t take into account whether you pay your balance in full each month (although you should do that!). For this factor, the bureaus simply look at your credit file at some point each month to see how much you have charged on each individual card and on all cards combined. Using less than 30% of your available credit is best for keeping your credit score strong. Even better if you use less than 10%. Closing an account means lowering your total available credit, thus increasing the percentage of utilization.

To keep all of this in context, keep two factors in mind. First, FICO says length of credit history accounts for just 15% of a credit-score calculation. The most important factor is paying your bills on time (“payment history”), which makes up 35% of your score. And second, your credit score is ever-changing. So, even if your score slips slightly after closing an account, it probably won’t stay that way for long. As long as you keep paying your bills on time and keep your credit utilization per card and across all cards to less than 30% of available credit, you should be fine.

They won’t let you go easily

When you call to close an account, be prepared for a plea to stay! And, in fact, sometimes it can pay to stay with a card a bit longer. That was my experience recently.

I rarely pay attention to credit card pitches, but on a flight earlier this year the flight attendants promoted a card with an unusually high mileage bonus for the airline we use most often. I already have a card that’s co-branded with the airline, but this one was from a different issuer. (Although the flight attendants said a decision needed to be made in-flight, I learned I could take a brochure with me and decide later.)

Soon enough, I opened the new account with the intention of closing my similar account. I called the issuer of the older card, explained I wanted to cancel before the annual fee was due, and was presented with a pitch to stay. They said if I charged another $1,000, I would get 7,500 bonus miles and still could cancel in time to avoid paying the fee. So that’s what I did.

I suppose they hope people will take the offer and never get around to canceling. I took the offer, wrote down exactly when I needed to cancel, and called back after making sure the additional miles had been credited to the account.

This time, they made another offer: a card with no annual fee. But that wasn’t enough of a benefit to keep me as a customer, so I went through with the cancellation.

Other things to consider

Before closing a card, you’ll have to pay off any remaining balance. Also, it’s wise to use up any available reward points tied to the card. One other thing: Don’t forget to update any bills that are currently auto-paid via the card you’re closing.

Image used with permission. *Image used with permssion. *Related Articles

May 21, 2025

The Danger of Buy Now, Pay Later

May 18, 2025

The Hidden Danger of Buy Now, Pay Later

In a culture of instant gratification, it's easier than ever to get what we want, even if we can't afford it....

March 2, 2025

What is good debt vs. bad debt?

Is all debt bad? Or does some good debt exist? Here are the biblical principles to discern the difference....